- #Suntrust online banking personal banking android#

- #Suntrust online banking personal banking password#

- #Suntrust online banking personal banking download#

#Suntrust online banking personal banking download#

Just click on any link to download the mobile app on your smartphone.

We are also sharing the direct app download links below to save you time. Customers can also directly visit the Apple App Store or Google Play store app on their smartphone and search for the Truist app.ĭirect links to download the Truist mobile apps:.Click the app link according to your device and download the app.

#Suntrust online banking personal banking android#

You will be redirected to the Truist digital banking page where you will find the Android and iOS app links just below the top menu.Open a web browser on your smartphone and visit the official website and navigate to Checking & savings > Online & mobile banking in the top menu.Please check the below steps to download the official website. Customers get some extra features and services that are only available in the Truist mobile app. The mobile app is highly recommended due to its ease of access, convenience, and advanced security. Truist mobile banking is accessible through a mobile browser or mobile app.

#Suntrust online banking personal banking password#

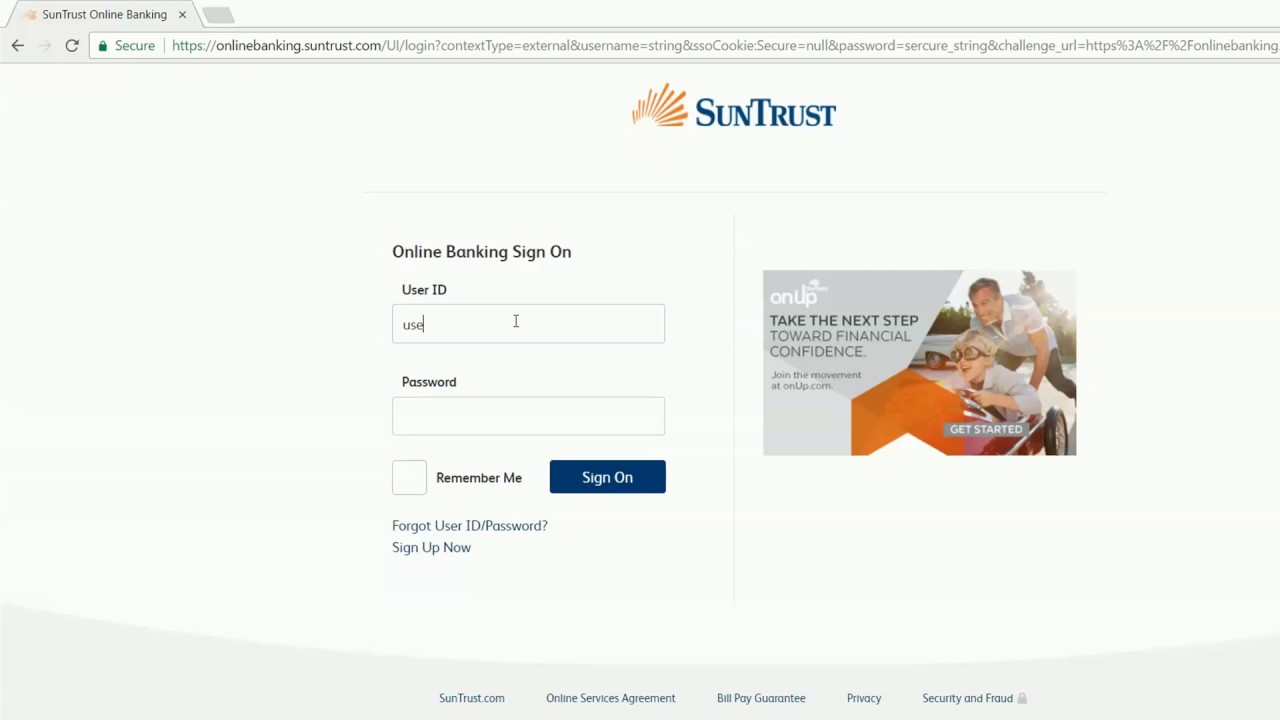

This User ID and Password will be used to access your online banking account through an online website or mobile app. Step 5: Complete the further process and create a new User ID and Password. If you don’t have a Truist account then you can click the fourth option to open a new account and enroll in online banking. Step 4: Select any one option and enter the required details and click the Continue button to proceed with the next steps. You will get the below-mentioned options to start your enrollment process. there is an option to register for business banking also if you are a business user. Regions Bank reserves the right to change the terms of or terminate this bonus program and prorate the amount of any bonus payment at any time in its sole and absolute discretion.Step 3: You will be redirected to an online personal banking form. The Annual Percentage Yield (APY) for the LifeGreen Savings account and the LifeGreen Preferred Checking (other Regions checking accounts do not pay interest) account is based upon balance and may change at any time. Fees could reduce earnings on the account. You are responsible for any tax due on any amount received under this offer. To receive the annual savings bonus, your LifeGreen Savings account must be open on the date the annual savings bonus is paid. The annual savings bonus will be paid to your LifeGreen Savings account by the second business day of the month following your Account Anniversary Month. The annual savings bonus is based on the average monthly balance for the 12 calendar months that precede your Account Anniversary Month. An automatic transfer of funds of at least $10 from your Regions checking account to your LifeGreen Savings account in at least 10 of any of the 12 calendar months that precede the month of your account opening anniversary (your “Account Anniversary Month”) is required to earn a 1% annual savings bonus. The minimum opening deposit amount for opening a LifeGreen Savings Account is $50 (or $5 if you set up a monthly automatic savings transfer from a Regions checking account). The minimum opening deposit amount for a Regions checking account is $50. To qualify for a LifeGreen Savings Account, you must have a Regions checking account.

Please note that IRA and Private Wealth Management deposits are subject to separate pricing terms and do not participate in Relationship Pricing. Details about Relationship Pricing and Standard Pricing are disclosed in time deposit account documentation and disclosures and are available from the Bank’s customer service representatives. If you do not meet the bank's relationship requirements, your account will earn the lower Standard Pricing interest rates and APYs. The primary or secondary designated owner on the time deposit must be the primary or secondary designated owner on an open Regions Bank checking account in good standing during the term of the time deposit.The time deposit term must be at least 32 days and.Advertised Relationship CD rates and APYs only available for advertised term lengths if (1) opened at a participating branch using the “Find a branch near you.” button above and (2) you meet the following Relationship Pricing requirements: Not available for brokered deposits, or to public entities, financial institutions, or Commercial Banking customers, as defined by Regions and/or as indicated in Regions’ records. Special or promotional rates may apply to certain accounts, are for a limited time only, and cannot be combined with other bonus rate offers.

0 kommentar(er)

0 kommentar(er)