You must apply by the deadline and you must submit proof to show you qualify. But the appraisal office doesn’t just automatically assume a property qualifies for the Texas Ag Exemption. So you want your taxes based on agricultural value, not the market value.

The assessed value of your property dictates the amount of tax you will owe. In general, the market value of any given property will assess for a higher amount than the agricultural value of the land. But how do they come up with the number that you owe each year? They figure out how much your property is worth and base it on that. The appraisal district is the name of the office in each county where you pay.

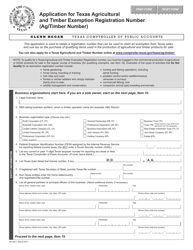

Technically, it is a “county appraisal district assessment valuation.” That sounds confusing, so let’s take a closer look. But the common term is Ag Exemption, so we will stick with that.Īn Ag Exemption is really another way of valuing a property resulting in much lower taxes than a market valuation. The first thing to understand about an Ag Exemption is that it actually isn’t an exemption at all. Motion to Correct One-Third Over-AppraisalĬorrection of Appraisal Roll Section 25.This article explores the question, “What is a Texas Ag Exemption?” The Texas Ag Exemption is fairly complex. So what is it? And why is it important if you are buying horse properties, land or ranches in Texas? EXEMPTION OR ASSESSMENT VALUATION? Owner authorization for agent representation Section 1.111 Prepayment of Taxes by Manufactured Housing Retailers Section 23.128ĪRB – Appraisal Review Board Notice of Protest Retail Manufactured Housing Inventory Tax Statement Retail Manufactured Housing Inventory Value Section 23.127 Retail Manufactured Housing Inventory Declaration Prepayment of Taxes by Heavy Equipment Dealers Section 23.1242 Prepayment of Taxes by Certain Taxpayers Section 23.125ĭealer’s Heavy Equipment Inventory Declarationĭealer’s Heavy Equipment Inventory Value Section 23.1241ĭealer’s Heavy Equipment Inventory Tax Statement Prepayment of Taxes by Certain Taxpayers Section 23.122ĭealer’s Vessel, Trailer and Outboard Motor Inventory Declaration / Confidentialĭealer’s Vessel and Outboard Motor Inventory Value Section 23.124ĭealer’s Vessel, Trailer and Outboard Motor Inventory Tax Statement / Confidential Special Inventory Dealer’s Motor Vehicle Inventory Declaration / Confidentialĭealer’s Motor Vehicle Inventory Value Section 23.121ĭealer’s Motor Vehicle Inventory Tax Statement / Confidential Rendition of Residential Real Property Inventory Special Appraisal * Agricultural/Wildlife Appraisal *** A taxpayer is entitled to a Homestead exemption on their principle/primary residence however, the Chief Appraiser cannot approve a homestead exemption unless a copy of the applicant’s driver’s license is submitted with your homestead application and the address on your driver’s license matches the address for which you are applying for the homestead exemption. Please contact the Comal Appraisal District for exceptions to the law. * Application for Exemption of Goods Exported from Texas ( Freeport Exemption)Īpplication for Exemption of Goods-In- TransitĪpplication for Solar or Wind-Powered Energy Devices Exemption * Disable Veteran’s Exemption (Disabled Vets with 10% to 90% rating) Exemptions * Homestead Exemption (including Regular Disabled, Over-65, and Homestead for 100% Disabled Veteran exemptions)

0 kommentar(er)

0 kommentar(er)